How Would You Explain P E Ratio Differences Among Companies

The industry average is 055. PE Ratio Earnings This Year Earnings Last Year-1 PEG Ratio.

Price Earnings Ratio Formula Examples And Guide To P E Ratio

For example a stock trading for 20 that earns 1 per share would have a PE ratio of.

. The difference between the two is that in the quick ratio inventory is. ABC has a PE ratio of 5 while XYZ has a PE ratio of 25. Price-Earnings Ratio - PE Ratio.

For example companies in high-growth categories like technology bio-tech emerging markets or start-ups or. However PE ratios are not a good measure of value. Free cash flow is calculated by taking the amount of cash a company makes from.

Factors explaining difference in priceearnings ratios among four companies A M T and W from different industries. How would you explain PE ratio differences among companies. A companys debt-to-equity ratio is 05.

A PEG ratio of 1 is considered fair market value. After all the PE ratio of the SP 500 has declined from 24 at the beginning of the year to 23 currently. To determine a PE ratio simply take a stocks current price and divide it by its annual earnings per share.

This means that investors are willing to pay 20-25 per 1 of company earnings. PE ratio Market Price per share Earnings per share A company with a lower PE ratio is considered under-valued compared to another company in the same sector with a higher PE ratio. For each share purchased youre getting 20 of earnings from XYZ rather than 10 in earnings from ABC.

Explaining differences in PE ratios. The formula for the PEG ratio is. Estimates about the recent growth of dividends.

High growth companies can justify higher PEs but PEs over30 are difficult to sustain with. Estimates of the recent growth of earnings. Expectations about the future growth of earnings.

Step 1 of 4. The average PE ratio for stocks hang around the 20-25 mark. The formula looks like this.

An overly optimistic PE Ratio can indicate the market expects big things from. By factoring in earnings growth investors get a more accurate picture of whether the stock is overvalued undervalued or trading at fair market value. The companies have been chosen with a range of PE ratios to give with a relatively low value one with a relatively.

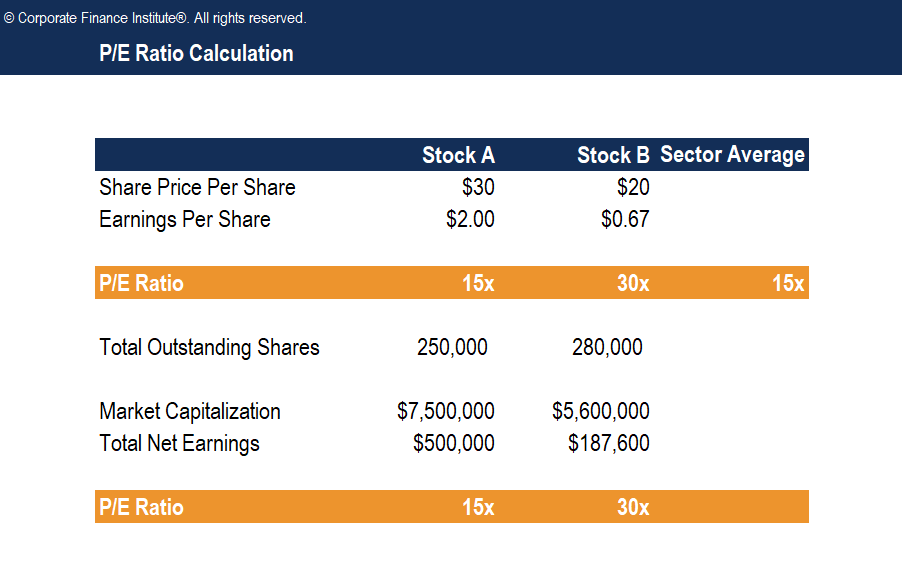

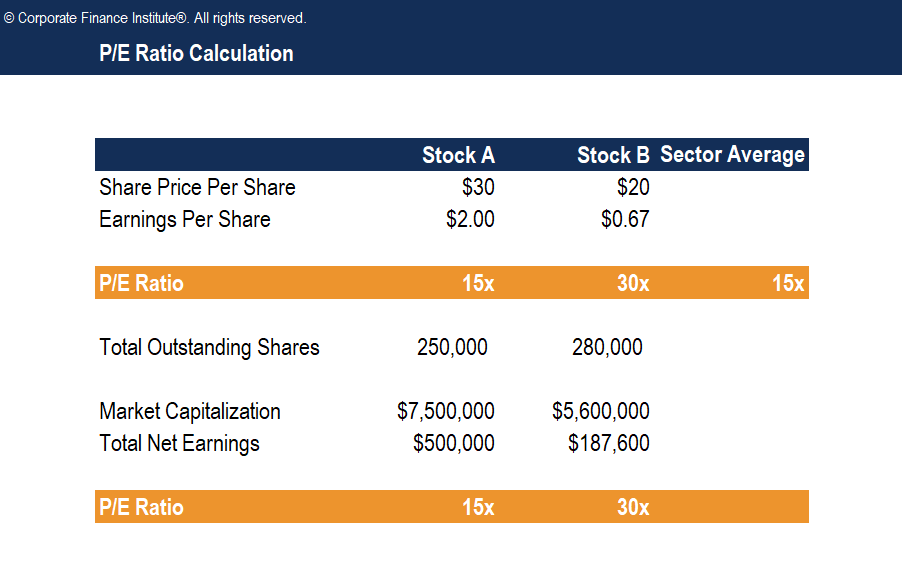

If the sectors average PE is 15 Stock A has a PE 15 and Stock B has a PE 30 stock A is cheaper despite having a higher absolute price than Stock B because you pay less for every 1 of current earnings. A high PE ratio could mean that a stock price is hi. The current ratio is an indicator of your companys ability to pay its short term liabilities debts.

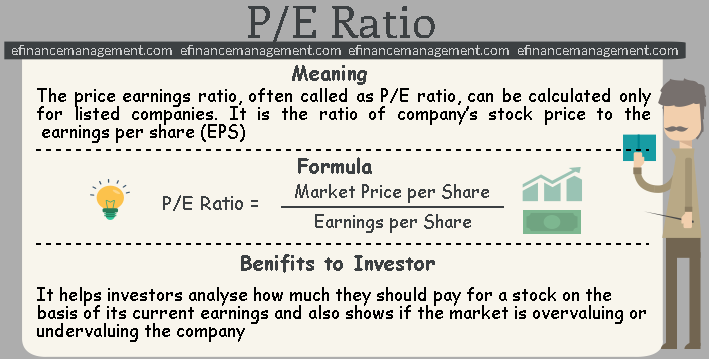

14x is considered a common PE ratio among financial sector companies. What factors might explain the difference in the PE ratios of these companies. The price-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to.

Enterprise Value to Revenue Multiple The Enterprise Value EV to Revenue multiple is a valuation metric used to value a business by dividing its enterprise value equity plus debt minus cash EVEBITDA and PE ratios. View this answer View this answer View. However there are certain industries where that average tends to be much lower or much higher.

The PE and PEG ratios are easy to find on most finance websites but you may need to determine PFCF yourself. Many investors concerned that the costs of higher debt will negatively impact the companys future earnings sell their shares in response causing share prices to decline. Thus a lower PE ratio does not always indicate higher stock value.

When a company increases its debt it can cause the PE ratio for its stock to fall. Finance questions and answers. The quick ratio sometimes called the acid-test is similar to the current ratio.

A very low PE implies that investors believe earnings are likely to decline in the future. If business risk decreases for Megabucks Inc the PE will. This increase in the debt-to-equity ratio could indicate managements decision to increase the companys debt load to better leverage the companys assets and equity and more closely.

A lower PE ratio likely implies a company is in its mature stage or has cyclical inconsistent earnings. Chapter 6 Problem 4E is solved. Discuss the factors that might explain the differences in the price earnings ratios of the three companies below and the changes that have occurred in their price earnings ratios over the period.

Common liquidity ratios are the current ratio the quick ratio and the cash ratio. XYZ is a better purchase at that time because of the lower share price along with similar earnings. The price to earnings ratio is one of the most widely used ratios by investors throughout the world.

PE Stock Price EPS. However Stock B has a higher ratio than both its competitor and the sector. The logic is that if similar companies are worth 10x earnings then the company thats being valued should also be worth.

PE ratio is calculated by. Expectations about the future growth of the market. In general the lower the PE ratio is the more valuable the companys shares are because you are paying less for the companys profits.

Investors are always looking for companies that increase in value due to their use of shareholders money. It is important to note that PE ratio is just one metric used to value stocks and no investment should be made on just a companys PE ratio alone. A dropping PE is an indication that the company is out of favor with investors.

A lower PE ratio means that companies are using their resources to produce the maximum amount of profit possible which ultimately benefits investors. Industrial Differences in PE Ratios PE ratios can be difficult to use to compare stocks in different industrial sectors because some industries have other market factors at play that shape typical PE ratios among their member companies. To derive the PE Ratio you divide the share price by the companys EPS or Earnings Per Share.

Comparison to the companys past three years shows that this ratio is usually 03 for the company.

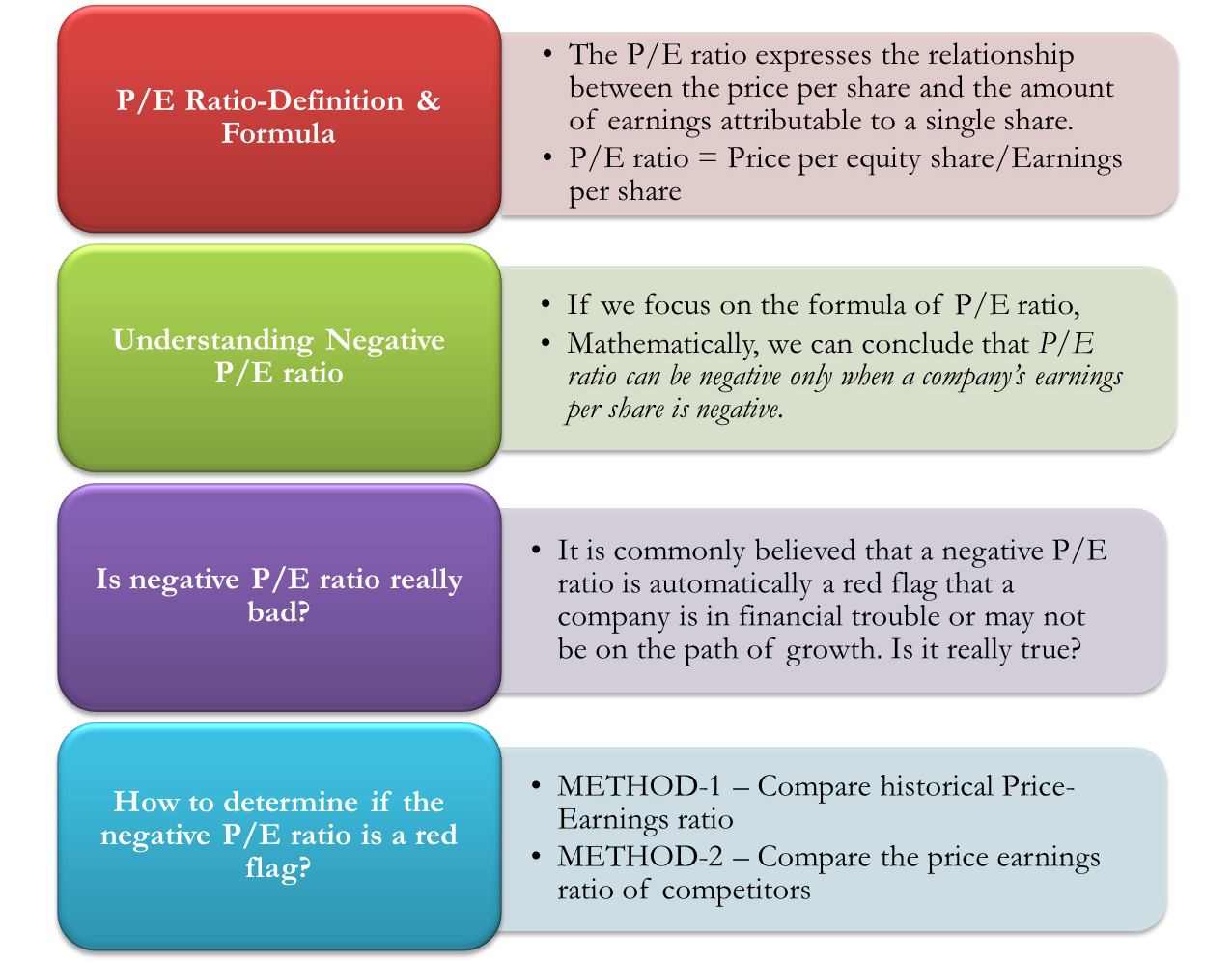

Negative P E Ratio Really A Red Flag Efinancemanagement Com

P E Ratio Meaning Valuation Formula Calculation Analysis More

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Belum ada Komentar untuk "How Would You Explain P E Ratio Differences Among Companies"

Posting Komentar